Policy Briefs

Deciphering the Value of the Infrastructure Loan

- December 7, 2016

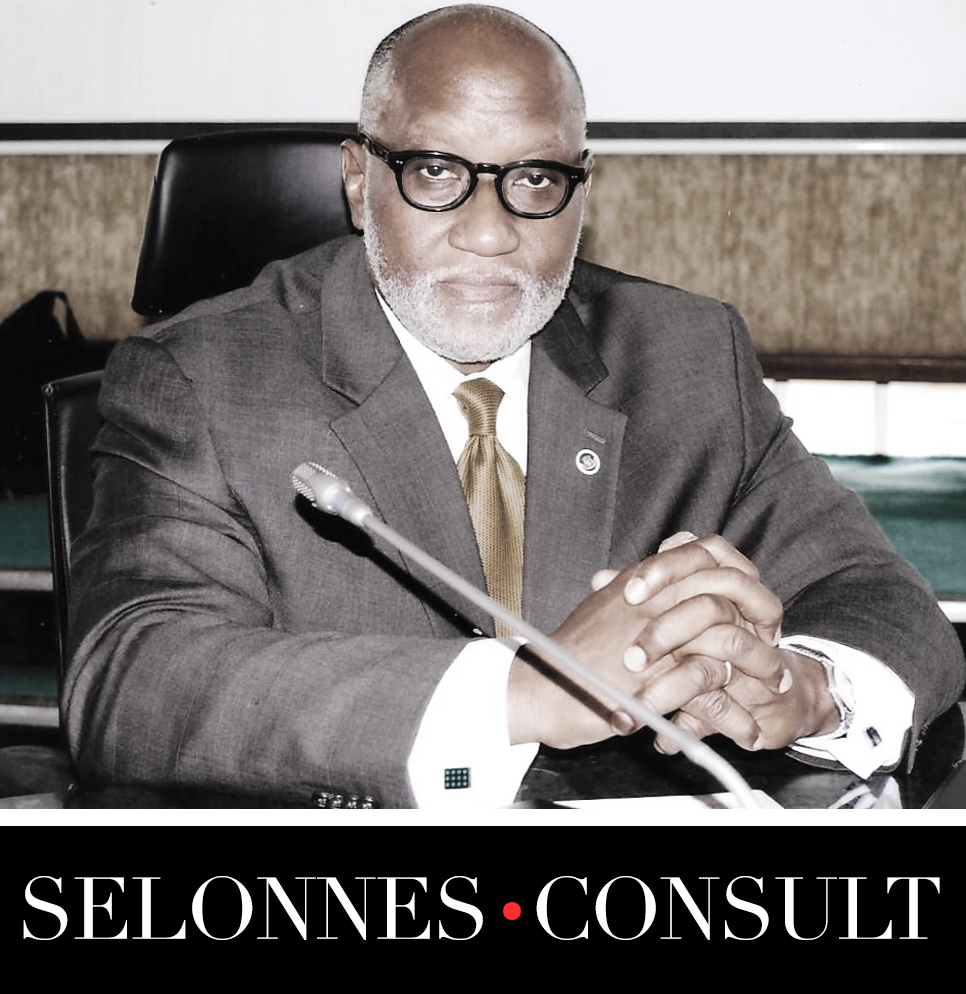

- By Oseloka Obaze, MD & CEO

- 0 Comment

By Oseloka H. Obaze & Izu J. Okoye ~~

Great value was lost in the skewed reportage of the keynote address delivered by Mohammad Sanusi, Emir of Kano in Abuja on 2 December, 2016. Emir Sanusi, the Federal Government and Nigerians were ill-served by the media’s embellishing of a fiscal element of the address. The reality remains as Sanusi observed that Nigeria is heavily enmeshed in debts that “out of every one Naira Nigeria makes, 40 kobo goes to debt and 60 kobo is left for salaries, health, education, power and infrastructure.” Proclaiming that Nigeria should borrow more in order to dig itself out of the present debt peonage seems counterintuitive. Yet such argument gains validity, if such borrowing is per se, for development. The redeeming caveat is ensuring “beyond financing established infrastructural needs…that aggregate expenditure is of such quantum and composition to enable exit from recession.”

The proposed $30 billion loan is tailored mainly to social infrastructure. It’s safe to assume implicit correlation between the $30billion infrastructural development loan and reported plans to offer N20 billion to 36 states respectively, for infrastructural development. The loan document, split into three parts – programmes and projects $11.247bn; special national infrastructure $10.686bn; and Eurobonds and federal budget support, $4.5bn and $3.5bn — didn’t include the sectoral narratives, which made it hard to discern the benefiting geopolitical or economic sectors. But we know this much. Nigeria’s infrastructures are in bad shape and needs remediation. But the dismal state of our infrastructure is hardly by happenstance; they failed gradually, through poor policy articulation and implementation, wrong priorities and wrong utilization of previous loans. Nigerians remain cognizant that past foreign loans dedicated to Nigeria’s steel sector yielded very limited results.

The value and amortization terms of any loan are best assessed, if the loan is meant for hard infrastructure – power, housing, toll bridges and roads – that yield returns. Same is not always true of loans for soft and social infrastructures. Thus, it may be wise to borrow for hard infrastructure; yet not so wise to borrow for soft infrastructure. This position does not discount the overarching importance of soft infrastructure, needed to promote quality of life and human development, since rising youth unemployment, inequality, and poor healthcare delivery are corollaries of growing disenchantment and portend risks. Nigeria having only extricated herself from the sapping London and Paris Club debts just a decade ago, some heady questions arise. Will Nigeria’s borrowing outcome be any different now? Here is the challenge: Can an external loan – quick-fix, ad-hoc funding – couched in the attractive term of “infrastructure fund” even if it serves as stimulus or bailout, begin to redress existing infrastructure deficit, if its utilization is not properly handled?

Infrastructural deficit in Nigeria remains huge with sectoral infrastructures suffering major setbacks, which manifest in dismal electric generation and distribution; crumbling roads and bridges that are further exacerbated by a poor maintenance culture. The deregulated national air transportation system struggles, due to the existing oligopolistic market structures. Recent census shows that the national commercial air fleet shrank from a total of 60 to 20 planes in the past year alone. Prevailing operational challenges translate to air safety concerns. Nigeria is also underserved by its limited ports and waterways infrastructure. The sector is hampered by navigable, but yet to be dredged inland waterways totaling some 3,300km, and dearth of modern vessels. Nigeria’s housing deficit is estimated at 16-20 million, but Nigeria’s housing infrastructure is so laggardly that even 20% of its housing needs are presently unrealizable. The mortgage sector remains dysfunctional, given prevalent inefficacious mortgage policies and regiment. Whereas real estate construction contributed $990 billion or some 6% of U.S. GDP in 2015, and 4% of GDP in Ghana, in Nigeria, contributions via mortgages is a dismal 0.5% of the GDP.

Whilst Nigeria’s GSM system is much improved, Nigeria’s 97 million GSM users are still underserved with only 21% broadband penetration. With Boko Haram destroying most GSM urban furniture in the Northeast; the national landline systems have totally collapsed and are non-existent in most parts of the country. Such setbacks are worsened by high tariffs, lack of periodic maintenance, insufficient public sector funding and unavailability of stable bond and capital markets. Even as Nigeria’s ICT sector yielded N1.4 trillion in FQ of 2016, the nexus between the parlous state of Nigeria’s communication infrastructure and her inability to fully catalyze the “use of ICTs for different aspects of national development” persists. Relatedly, Nigeria’s rating on the World Economic Forum’s Global Competitiveness index, which assesses “countries’ ability to have good and steady electricity supply, road quality construction, air transportation, and port and rail infrastructures”, remains bleak. Two consecutive surveys between 2014 and 2016 ranked Nigeria 133rd and 134th respectively, out of 144 countries.

Infrastructure funding and challenges were of lesser concern during the military era. Because democratically elected governments view infrastructure development as democratic dividends, the Jonathan administration prioritized infrastructural development via the National Integrated Infrastructure Master Plan (NIIMP), which linked key economic sectors. The plan envisaged to last for 30 years, would guarantee sustainable economic growth and development and bridge existing infrastructure deficit, if fully implemented. Still Nigeria has suffered from the inability of successive governments to follow through on approved infrastructural projects. Hence, leadership change and politicians jockeying for preferential funding and sitting of constituency projects, continue to impact negatively on infrastructure development.

The value of Nigeria’s infrastructure is relative to her historical realities regardless of whether the funding is borrowed or budgeted. Historical realities also reflect the federal government’s unending inability to leverage accruing oil revenue to develop national infrastructure fully. Resultantly, poorly funded and executed policies have contributed to awful deliverance or abandonment of strategic infrastructural projects. Meanwhile, States are increasingly averse to rehabilitating decrepit federal infrastructures, given extant policies prohibiting such repairs without prior authorization and challenges in recouping funds expended by States on federal projects.

Funding infrastructure via budgets or loans is no longer as important as finding the political will for executing and delivering national projects fully. Not delivering on requisite infrastructure amounts to shortchanging the national population and retarding development. As Ejeviome E. Otobo, averred in the recent edition of Jeune Afrique, “The ability of all tiers of government to increase citizens’ access to pipe-borne water, public healthcare and of the federal government to increase electricity supply will be an important test of their commitment to inclusive growth.” And as Abraham Nwankwo, Nigeria’s debt management czar observed; “If the economy does not succeed in converting the external borrowings to domestic productive capacity and self-sustaining economic growth, with substantial diversified export component, the resulting economic and social disruption will be unbearable.” Translated from our historical past to here-and-now, “unbearable” means recession, which is the new normal for Nigeria. Hence, advancing Nigeria does not require a foreign loan likely to be mismanaged, but a clear delineation of institutional structures and responsibilities for driving the deployment of critical national infrastructure. Such delineation will influence funding, resource and burden sharing among the three tiers of government, with a view to improving domestic productive capacity and sustainable development.

—

Obaze MD/CEO, Selonnes Consult Ltd.; Okoye is a Research Associate, at Selonnes Consult Ltd.

Oseloka Obaze, MD & CEO

Mr. Obaze is the former Secretary to the State Government of Anambra State, Nigeria from 2012 to 2015 - MD & CEO, Oseloka H. Obaze. Mr. Obaze also served as a former United Nations official, from 1991-2012, and as a former member of the Nigerian Diplomatic Service, from 1982-1991.

Tags

Welcome to Selonnes Consult / OHO and Associates

Selonnes Consult Ltd. is a Strategic Policy, Good Governance and Management Consulting Firm, founded by Mr. Oseloka H. Obaze who served as Secretary to Anambra State Government from 2012-2015; a United Nations official from 1991-2012 and a Nigerian Foreign Service Officer from 1982-1991.

Recent Posts

- Policy Brief No. 24-7| Overcoming Nigeria’s Legacy of Woes

- Policy Brief No. 24-6| Nigeria’s Not Too Big To Fail By Oseloka H. Obaze

- Policy Brief No. 24-5 | Nigeria’s Opposition Abet APC’s Grim Governance

- Policy Brief No. 24-4 |Blame Game Is Not Policy Game

- Policy Brief No. 24-3 | Implementing Oronsaye Report – No Walk in the park..

Categories

- #BuFMaNxit

- #EndSARS

- 2020 appropriations

- 2023 Appropriations

- 2023 buget estimates, 2024 budget estimate, FGN

- 2023 Liberian general elections

- 2024 Approriations

- Abia State

- Abuja

- Afghanistan

- Africa

- Africa’s largest economy

- AGF Malami

- Agonizing reprisals

- Alumni Association

- Aminu Waziri Tambuwal

- Amotekun

- Anambra

- Anambra Integrated Development Strategy

- Anambra state

- ANIDS

- Announcement

- Announcements

- Anonymous

- Apartheid

- APC

- APC, continuity in governance, budget performance

- Atiku Abubakar

- Bad Governance

- Bandits

- Beyond oil economy

- Bi-partisan caucus

- Biography

- Boko Haram

- Bola Tinubu

- Book Review

- Budget making

- Buget Padding

- Buhari

- Building Coalition

- Bukola Saraki

- Burkina Faso

- CAC

- Capacity building

- Capital Flight

- Career Counseling

- Central Bank of Nigeria

- Central Minds of Government

- Chief Security Officers

- Chieftaincy

- China

- Chinese doctors

- Chinua Achebe

- Civil Service reform

- Civil Society

- Civilian joint task force

- CKC Onitsha

- Clientel

- Climate Change

- Community policing

- Community resiliency

- Community transmission

- Conferences

- Consitutional Reform

- Constitutional Rights

- COP28

- Corona Virus Facts

- Corporate Exits,

- corporate social responsibility

- Cost of governance

- Coved 19 management

- Covid 19 Case Load

- Covid 19 vaccine policy

- Covid-19

- Cross political tier aspirations

- CSOs

- Culture

- Curriculum Vitae

- Customer Relationship

- Cutting Cost of Governance

- Cyril Ramaphosa

- Democracy

- Demolitions in Nigeria

- Development

- Disaster response

- Diseent

- Domestic terrorism

- Donald Trump

- Doublethink

- Ebola

- Economic Policy

- Economy

- ECOWAS

- Education

- Elections

- EMS

- Enabling environmrnt

- Endogenous solutions to conflict

- EndSARSnow

- Enugu state

- Environment

- Environmental degredation

- Escalatory measures

- EU

- Events

- Executive Order No. 5

- Fake news

- Fake news versus freedom of speech

- Farmers/Herdsmen conflict

- Fatalities

- Faux Policies

- FGN

- First Responders

- Fiscal Policy

- Fishermen

- Flooding

- Food security

- Forced Removals

- Foreign exchange

- Foreign Policy

- Full disclosure

- Gen Soliemani

- Gender inclusion

- Gender mainstreaming

- Gender parity

- Gender Policy

- General News

- Generator Country

- Genocide

- Girl-child

- Global best practices

- Global Compact

- Global housing crisis

- Global insecurity

- Global pandemic

- Global respone

- Good Governance

- Grazing areas

- Groupthink syndrome

- Habitat

- Hate Speech

- Herdsmen

- Hisbah security outfits

- History

- Housing Deficit

- human capital

- Human development capital

- Human rights violations

- Human Security

- IGR

- INEC

- Insecurity

- Inter-community conflicts

- International relations

- Interview

- iOCs

- Iran

- Iraq

- Joe Biden

- Joe Garba

- Judiciary

- Kamala Harris

- Kankara

- Kano

- Kaño State

- Katsina State

- Kidnapping

- King Louis IX.

- Kofi Annan

- Labour Unions

- Lady Chidi Onyemelukwe

- Lagos

- Leadership

- Leadership hubris

- Legislative oversight

- Lesotho

- Libel

- Liberia,

- Literary Event

- Lock down

- Malgovernance

- Mali

- Media

- Media accountability

- Migration

- militancy

- Military coups in Africa

- Millennium Development Goal

- Minister of Health, Dr Osagie Ehanire

- Misgovernance

- Mitigation

- MNCs

- Motivational Speeches

- Muhammadu Buhari

- NAFDAC

- NASS

- Nation building

- National interest

- National resiliency strategy

- National Security

- Nationalists,

- NATO

- Natural Disaster

- NCDC

- NDA – the Nigerian Defence Academy

- NEMA

- New York Times

- Niger

- Niger Delta

- Nigeria

- Nigeria Medical Association

- Nigerian Economy

- Nigerian elite, democracy

- nigerian military

- Nigerian Senate

- Nigerian Society of Writers

- Nigerian Supreme Court.

- Nigerian Youth

- Nigerian-German relations

- NMA

- Nobel Peace Prize

- Non-state actors

- Novel corona virus

- Obituary

- oil prices

- Oil subsidy

- Onitsha

- Op-Ed.

- Operational Activities

- Opposition Politics

- Oronseye Report

- Oseloka H. Obaze

- Pacesetter Frontier Magazine

- Palliatives

- Pandemic

- Party politics

- Party Politics In Africa

- Pastoral Conflict

- PDP

- PDP Governorship Candidate

- Peace and security

- PENCOM

- Pension contributions

- Peter Obi

- Petroluem policy

- philosophy

- Piracy

- Police Brutality

- Policy Brief

- Policy Making

- Policy transparency

- Political Economy

- Political economy.

- Political exclusion

- Political inclusion

- Politics

- Power and Energy

- Press Remarks / Press Releases

- Preventive measures

- Prime Witness book presentation

- Proactive Policing

- Promotions & Offers

- Public Notice

- Quarantine

- R & D

- Racial inequality

- Regional blocs

- Regional hegemon

- Regional security network

- Regulatory Policies

- Renewable energy

- Research and development

- Responsibility to protect

- Restructuring

- Rule of law

- Russia

- Rwanda

- Safety Net Hospital

- Saigon

- SARS

- SDG

- Seasonal Floods

- Security

- Sedition

- Selonnes Consult

- SEMA

- Senator Hope Uzodinma

- Senator Stella Oduah

- Senator Uche Ekwunife

- Separation of Powers

- Services

- Shale tecnology

- Shelter in Place

- Six geopolitical zones

- SMes UNIDO

- Social distancing

- Society for International Relations Awareness (SIRA)

- South Africa

- Southeast Nigeria

- Special Intervention Programme (SIP)

- Speeches

- State police

- State vigilantes

- Stay at home order

- Stay home orders

- Strategic planning

- Strength of Government

- Tampering with free speech

- Taxes

- Technology

- Tecnology

- The Blame Game

- The Peter Principle

- The Policy Game

- Think Tank

- Three Arms of government

- Three Tiers of Government

- Treason to the Constitution

- Tributes

- Tweets

- U.S.

- UN

- UN peacekeeping

- UN sanctions

- Uncategorized

- UNEP

- Ungoverned space

- Ungoverned space,

- United Nations

- United States

- Unity Party of Liberia

- Upcoming Events

- US strategic interest

- Value added tax

- Wale Edu

- Ways and Means

- West Africa and Sahel

- White House

- Women for Women

- Women in politics in Nigeria

- World Bank

- Xenopbobia

- Yemi Osinbajo

- Youth

- Zoning,

Archives

- June 2024

- March 2024

- February 2024

- January 2024

- December 2023

- September 2021

- August 2021

- July 2021

- April 2021

- March 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- July 2015

Contact Info

MD & CEO

Oseloka H. ObazeA301 Chukwuemeka Nosike Street, Suite # 7, Awka, Anambra State, Nigeria

Phone: NG: 0701-237-9333Mobile: US: 908-337-2766Email: Selonnes@aol.com, Info@selonnes.com