Policy Briefs

Selonnes Policy Tidbits: | Despite Unbundling of Nigeria’s oil industry, overall work plan remains uncertain due to policy dissonance and uncertainties

- December 15, 2023

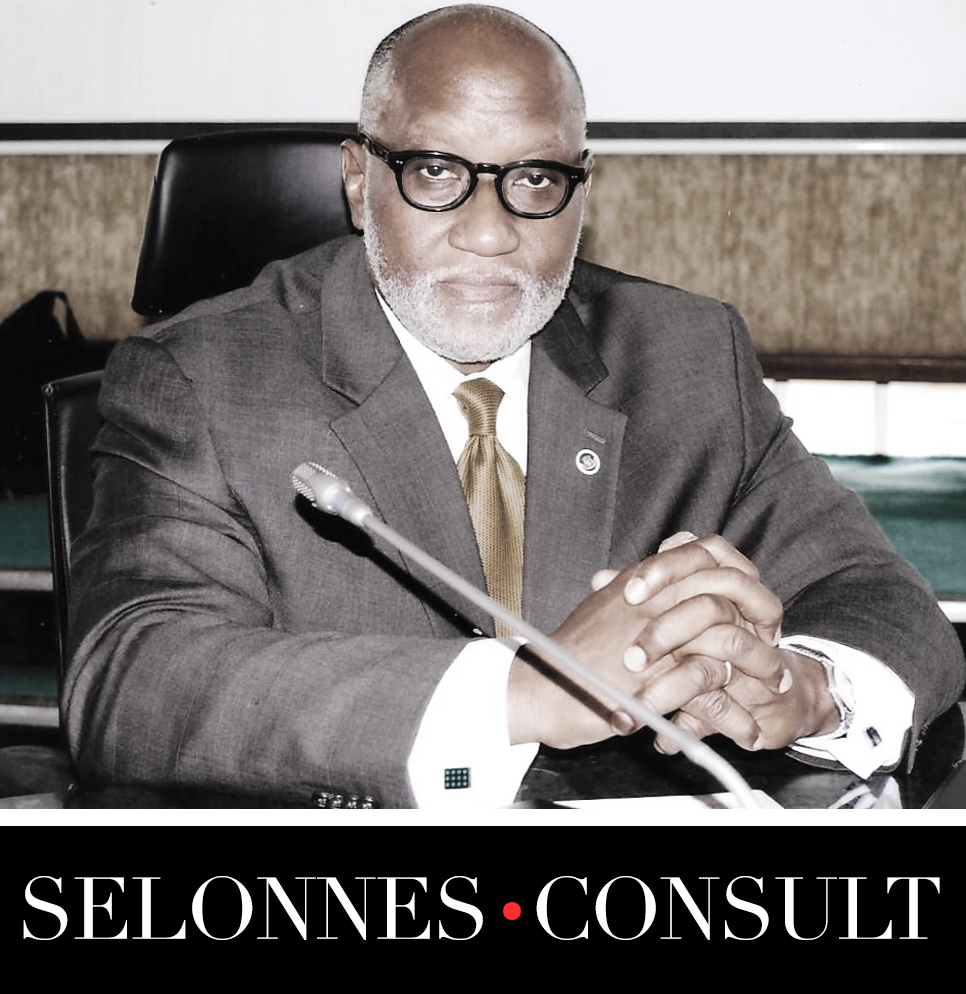

- By Oseloka Obaze, MD & CEO

- 0 Comment

It took several years to arrive at the unbundling of Nigeria’s petroleum and allied oil industry. The requisite legislation is in place and there has been perceptible movements, but policy dissonance and uncertainties continue to stymie forward planning. Nigeria’ prevailing forex imbroglio has further compounded prevalent challenges.

Nigeria’s four major oil refineries are still mothballed. So all operational hopes, energy and aspirations are foisted on the Dangote Refinery, and whatever residual output international oil companies (IOCs) can muster. But there is a Catch-22. In the policy realm, the FGN has been reticent and not exactly proactive in emphasizing protection of foreign investors’ interests. This was a point no other candidate except Peter Obi canvassed during the 2023 presidential campaign; Obi always stressed commitment “to enforce the legal framework protecting foreign investors and their indigenous partners” with a view to “tamper monopoly and capital flight.”

Presently, with the $20bn Dangote refinery not fully operational, the IOCs are surreptitiously leaving Nigeria’s oil industry. They are cutting their losses and heading home, perhaps, uncertain as to how they will fare when Dangote’s refinery is fully up and running. Most fear the FGN will default to “traditional protectionism,” given its almost 30% investment, and its hedging on the indigenously-owned refinery as its option of last resort. This development ought to trouble Nigerian policymakers.

The names of some exiting and divesting companies are already in the public domain. Yet, many more are on the drawing board or are deliberately being kept under wraps. Beyond, Exxon Mobil, Addax of China, and Eni of Norway, there are certainly more OIC on their way out from Nigeria.

Whereas this development may yet prove beneficial to Nigeria in the long term, given good prospects of ending import of refined petroluem that is presently fraught with subsidy controversy and criminality; Nigeria may well become a net exporter of refined petroluem. But there are too many ifs, all hinged on policies that are equally fraught with dissonance. How the exiting companies will settle or resolve their obligations to mitigate and clean up blighted environments in areas where they had operations, remains another sticky issue. Full disclosure will be imperative. While it will be precipitate to suggest that the exiting companies are trying to avoid their real and vicarious liabilities; the sector deserves continued introspective monitoring.

Oseloka Obaze, MD & CEO

Mr. Obaze is the former Secretary to the State Government of Anambra State, Nigeria from 2012 to 2015 - MD & CEO, Oseloka H. Obaze. Mr. Obaze also served as a former United Nations official, from 1991-2012, and as a former member of the Nigerian Diplomatic Service, from 1982-1991.

Welcome to Selonnes Consult / OHO and Associates

Selonnes Consult Ltd. is a Strategic Policy, Good Governance and Management Consulting Firm, founded by Mr. Oseloka H. Obaze who served as Secretary to Anambra State Government from 2012-2015; a United Nations official from 1991-2012 and a Nigerian Foreign Service Officer from 1982-1991.

Recent Posts

- Policy Brief No. 24-7| Overcoming Nigeria’s Legacy of Woes

- Policy Brief No. 24-6| Nigeria’s Not Too Big To Fail By Oseloka H. Obaze

- Policy Brief No. 24-5 | Nigeria’s Opposition Abet APC’s Grim Governance

- Policy Brief No. 24-4 |Blame Game Is Not Policy Game

- Policy Brief No. 24-3 | Implementing Oronsaye Report – No Walk in the park..

Categories

- #BuFMaNxit

- #EndSARS

- 2020 appropriations

- 2023 Appropriations

- 2023 buget estimates, 2024 budget estimate, FGN

- 2023 Liberian general elections

- 2024 Approriations

- Abia State

- Abuja

- Afghanistan

- Africa

- Africa’s largest economy

- AGF Malami

- Agonizing reprisals

- Alumni Association

- Aminu Waziri Tambuwal

- Amotekun

- Anambra

- Anambra Integrated Development Strategy

- Anambra state

- ANIDS

- Announcement

- Announcements

- Anonymous

- Apartheid

- APC

- APC, continuity in governance, budget performance

- Atiku Abubakar

- Bad Governance

- Bandits

- Beyond oil economy

- Bi-partisan caucus

- Biography

- Boko Haram

- Bola Tinubu

- Book Review

- Budget making

- Buget Padding

- Buhari

- Building Coalition

- Bukola Saraki

- Burkina Faso

- CAC

- Capacity building

- Capital Flight

- Career Counseling

- Central Bank of Nigeria

- Central Minds of Government

- Chief Security Officers

- Chieftaincy

- China

- Chinese doctors

- Chinua Achebe

- Civil Service reform

- Civil Society

- Civilian joint task force

- CKC Onitsha

- Clientel

- Climate Change

- Community policing

- Community resiliency

- Community transmission

- Conferences

- Consitutional Reform

- Constitutional Rights

- COP28

- Corona Virus Facts

- Corporate Exits,

- corporate social responsibility

- Cost of governance

- Coved 19 management

- Covid 19 Case Load

- Covid 19 vaccine policy

- Covid-19

- Cross political tier aspirations

- CSOs

- Culture

- Curriculum Vitae

- Customer Relationship

- Cutting Cost of Governance

- Cyril Ramaphosa

- Democracy

- Demolitions in Nigeria

- Development

- Disaster response

- Diseent

- Domestic terrorism

- Donald Trump

- Doublethink

- Ebola

- Economic Policy

- Economy

- ECOWAS

- Education

- Elections

- EMS

- Enabling environmrnt

- Endogenous solutions to conflict

- EndSARSnow

- Enugu state

- Environment

- Environmental degredation

- Escalatory measures

- EU

- Events

- Executive Order No. 5

- Fake news

- Fake news versus freedom of speech

- Farmers/Herdsmen conflict

- Fatalities

- Faux Policies

- FGN

- First Responders

- Fiscal Policy

- Fishermen

- Flooding

- Food security

- Forced Removals

- Foreign exchange

- Foreign Policy

- Full disclosure

- Gen Soliemani

- Gender inclusion

- Gender mainstreaming

- Gender parity

- Gender Policy

- General News

- Generator Country

- Genocide

- Girl-child

- Global best practices

- Global Compact

- Global housing crisis

- Global insecurity

- Global pandemic

- Global respone

- Good Governance

- Grazing areas

- Groupthink syndrome

- Habitat

- Hate Speech

- Herdsmen

- Hisbah security outfits

- History

- Housing Deficit

- human capital

- Human development capital

- Human rights violations

- Human Security

- IGR

- INEC

- Insecurity

- Inter-community conflicts

- International relations

- Interview

- iOCs

- Iran

- Iraq

- Joe Biden

- Joe Garba

- Judiciary

- Kamala Harris

- Kankara

- Kano

- Kaño State

- Katsina State

- Kidnapping

- King Louis IX.

- Kofi Annan

- Labour Unions

- Lady Chidi Onyemelukwe

- Lagos

- Leadership

- Leadership hubris

- Legislative oversight

- Lesotho

- Libel

- Liberia,

- Literary Event

- Lock down

- Malgovernance

- Mali

- Media

- Media accountability

- Migration

- militancy

- Military coups in Africa

- Millennium Development Goal

- Minister of Health, Dr Osagie Ehanire

- Misgovernance

- Mitigation

- MNCs

- Motivational Speeches

- Muhammadu Buhari

- NAFDAC

- NASS

- Nation building

- National interest

- National resiliency strategy

- National Security

- Nationalists,

- NATO

- Natural Disaster

- NCDC

- NDA – the Nigerian Defence Academy

- NEMA

- New York Times

- Niger

- Niger Delta

- Nigeria

- Nigeria Medical Association

- Nigerian Economy

- Nigerian elite, democracy

- nigerian military

- Nigerian Senate

- Nigerian Society of Writers

- Nigerian Supreme Court.

- Nigerian Youth

- Nigerian-German relations

- NMA

- Nobel Peace Prize

- Non-state actors

- Novel corona virus

- Obituary

- oil prices

- Oil subsidy

- Onitsha

- Op-Ed.

- Operational Activities

- Opposition Politics

- Oronseye Report

- Oseloka H. Obaze

- Pacesetter Frontier Magazine

- Palliatives

- Pandemic

- Party politics

- Party Politics In Africa

- Pastoral Conflict

- PDP

- PDP Governorship Candidate

- Peace and security

- PENCOM

- Pension contributions

- Peter Obi

- Petroluem policy

- philosophy

- Piracy

- Police Brutality

- Policy Brief

- Policy Making

- Policy transparency

- Political Economy

- Political economy.

- Political exclusion

- Political inclusion

- Politics

- Power and Energy

- Press Remarks / Press Releases

- Preventive measures

- Prime Witness book presentation

- Proactive Policing

- Promotions & Offers

- Public Notice

- Quarantine

- R & D

- Racial inequality

- Regional blocs

- Regional hegemon

- Regional security network

- Regulatory Policies

- Renewable energy

- Research and development

- Responsibility to protect

- Restructuring

- Rule of law

- Russia

- Rwanda

- Safety Net Hospital

- Saigon

- SARS

- SDG

- Seasonal Floods

- Security

- Sedition

- Selonnes Consult

- SEMA

- Senator Hope Uzodinma

- Senator Stella Oduah

- Senator Uche Ekwunife

- Separation of Powers

- Services

- Shale tecnology

- Shelter in Place

- Six geopolitical zones

- SMes UNIDO

- Social distancing

- Society for International Relations Awareness (SIRA)

- South Africa

- Southeast Nigeria

- Special Intervention Programme (SIP)

- Speeches

- State police

- State vigilantes

- Stay at home order

- Stay home orders

- Strategic planning

- Strength of Government

- Tampering with free speech

- Taxes

- Technology

- Tecnology

- The Blame Game

- The Peter Principle

- The Policy Game

- Think Tank

- Three Arms of government

- Three Tiers of Government

- Treason to the Constitution

- Tributes

- Tweets

- U.S.

- UN

- UN peacekeeping

- UN sanctions

- Uncategorized

- UNEP

- Ungoverned space

- Ungoverned space,

- United Nations

- United States

- Unity Party of Liberia

- Upcoming Events

- US strategic interest

- Value added tax

- Wale Edu

- Ways and Means

- West Africa and Sahel

- White House

- Women for Women

- Women in politics in Nigeria

- World Bank

- Xenopbobia

- Yemi Osinbajo

- Youth

- Zoning,

Archives

- June 2024

- March 2024

- February 2024

- January 2024

- December 2023

- September 2021

- August 2021

- July 2021

- April 2021

- March 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- July 2015

Contact Info

MD & CEO

Oseloka H. ObazeA301 Chukwuemeka Nosike Street, Suite # 7, Awka, Anambra State, Nigeria

Phone: NG: 0701-237-9333Mobile: US: 908-337-2766Email: Selonnes@aol.com, Info@selonnes.com